Peter Drucker coined the phrase "knowledge workers" in his 1957 book The Landmarks of Tomorrow. Examples include software engineers, lawyers and others whose job is to “think for a living.” In his later writings, Drucker felt "the most valuable asset of a 21st-century institution, whether business or non-business, will be its knowledge workers and their productivity."

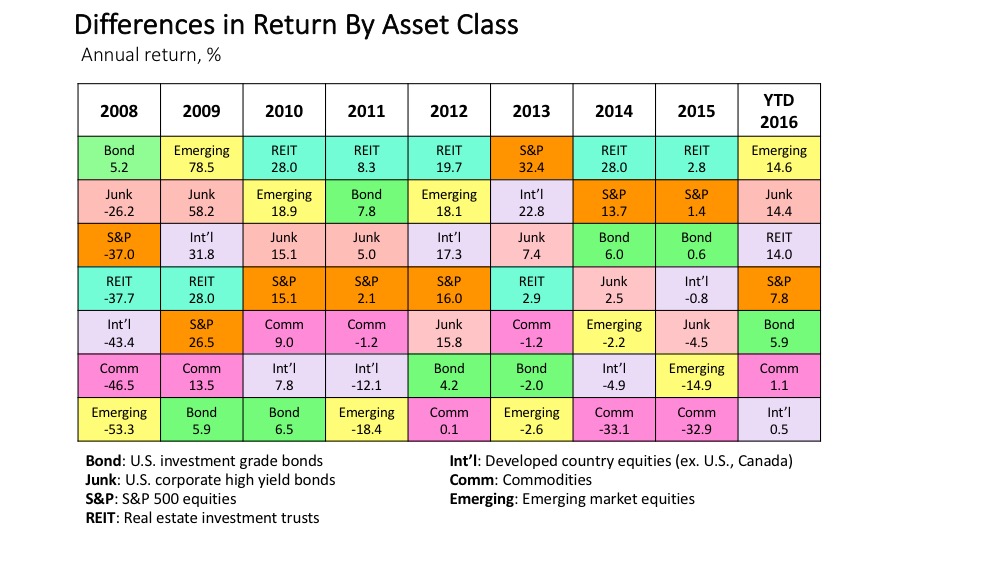

If so valuable and productive, how much more are knowledge workers paid relative to people with manual and/or routine jobs? Knowledge workers like software engineers, data scientists, and lawyers earn approximately $50,000 a year more than truck drivers and construction workers, based on data from Glassdoor, one of the fastest growing jobs and recruiting web sites. As shown in the chart below, the median annual base pay earned by construction workers and truck drivers in the United States was $37,153 and $52,422, respectively. The median wage in the other three occupations was on average about $50,000 a year higher.

This is a meaningful difference, especially as it adds up over a long-term career. But the wage differential for lawyers is much smaller when you factor in the cost of 3 years of law school and the associated forgone income while at school. Software engineers and data scientists, in contrast, do not have to pursue a post-graduate degree to land a high paying job while most truck drivers and construction workers do not need a college degree.

How much of a premium do knowledge workers earn in major cities? Living in New York and San Francisco can be exciting, but expensive. As shown below, people in the three knowledge-based occupations who work in New York City are earning 20 to 35 percent more than the national medians. The premiums are even higher in San Francisco. For example, data scientists are earning a 38.2 percent premium vis-à-vis the national median while lawyers are earning almost 50 percent more. Truck drivers and construction workers in these cities are also earning more, but the size of the wage premiums is lower.

DISCLAIMER: This information is not intended to provide legal or accounting advice, or to address specific situations. Please consult with your legal or tax advisor to supplement and verify what you learn here. This is presented for informational or educational purposes only and does not constitute a recommendation to buy/sell any security investment or other product, nor is this an offer or a solicitation of an offer to buy/sell any security investment or other product. Any opinion or estimate constitutes that of the writer only, and is subject to change without notice. The above may contain information obtained from sources believed to be reliable. No guarantees are made about the accuracy or completeness of information provided. Past performance is no guarantee of future results.